Value creation model

This model is based on the IFRS Foundation’s blueprint and shows how we generate sustained value through our business activities and interaction with our stakeholders, covering both financial and non-financial aspects.

Input*

Output1

1All figures as of end-2025 unless otherwise stated.

2 Includes 28 Client Relationship Officer (CRO) hires approved and entering in 2026 and 67 CROs who were onboarded as part of the acquisition of Cité Gestion and of ISG.

3 This compares with a total of CHF 27.8 billion of Assets under Management (AuM) invested in our New Capital business line of products as well as our discretionary managed assets (excludes Cité Gestion).

Delivering bespoke financial solutions on a global scale

As a global private banking group, EFG’s strategy builds on its core strengths – effectively combining local know-how in a global network, strong client focus and a comprehensive and impartial product and service offering. A strong risk management and regulatory compliance framework are a prerequisite to generating profitable and sustainable growth for the benefit of our stakeholders.

EFG serves its clients through five business regions, which are supported by two global divisions specialising in investment and client solutions and capital market products and services. EFG’s business regions and global divisions work together closely to provide clients with financial solutions that are tailored to their individual needs and designed to deliver on their financial objectives.

Organisational set-up

Business region

Global divisions

Strategy & value proposition

We are a leading Swiss private bank with a global footprint and a comprehensive offering of products and services. Our clients and the Client Relationship Officers (CROs) who serve them are at the core of EFG’s value proposition. Our CROs combine their strong client focus and local know-how with EFG’s global reach and holistic client solutions.

Our 2026–2028 strategic framework

EFG’s 2026-2028 strategic plan is focused on consistent performance and the power of compounding. This means that we want to leverage our strong track record and solid foundations to unlock new opportunities for growth. Our strategy builds on our well-diversified business model and our robust compliance culture and prudent risk management, as well as our operational resilience and financial strength.

EFG’s 2026–2028 strategic framework is designed to create sustainable, long-term value for all our stakeholders. We are confident in our ability to continuously grow our net new assets and earnings per share and to deliver an attractive return on capital by leveraging the strength and resilience of our business model.

Building on our strengths

In this new strategic cycle, we will build on the strengths of our business model across three areas: Clients, Content and Simplicity & Technology.

Clients: EFG’s client-centric model has been the engine of our growth for more than three decades and it empowers us to serve our clients effectively.

Content: Since 2019, we have made significant progress in strengthening our investment offering, client solutions and advisory capabilities. Delivering impartial, high-quality advice is our core priority.

Simplicity: We have adopted a “Simplicity mindset” across EFG and established the core foundations for technology-enabled growth.

Capturing new opportunities for growth

Building on these strengths, we have identified opportunities to generate further growth, to capture opportunities in the current environment and to meet the evolving needs of our clients.

While the philosophy behind our CRO model has remained unchanged since it was introduced more than three decades ago, we have continued to enhance it over the years. In this strategic cycle, we will focus on elevating the model by ”augmenting” CROs − combining their expertise with advanced state-of-the-art tools and capabilities.

This evolution reinforces our commitment to delivering the best possible service and advice to our clients, while preserving the entrepreneurial spirit and client proximity that defines EFG. An increased focus on commercial excellence will allow us to take our client service to the next level of sophistication, deploying the full capabilities of EFG’s teams to meet individual client needs. At the same time, increased investments in branding and the client experience will support our ambition to consistently meet or exceed our clients’ expectations.

While our strategy centres on the achievement of organic growth, selective M&A can strengthen and complement our growth trajectory, depending on developments in the market as the current phase of consolidation continues. In line with our M&A strategy, we will consider value-accretive acquisition opportunities that represent a good cultural fit for EFG with the aim of accelerating market share gains or acquiring new capabilities in strategic markets where we are already present.

An unwavering focus on compliance and risk

EFG's strong compliance culture and prudent risk management are prerequisites for sustainable and profitable growth. We manage both functions centrally and are further enhancing their capabilities through the rollout of digital tools as part of our commitment to consistently strengthening our operational and financial resilience.

At EFG, we believe that our people are central to the successful execution of our strategy and remain our most important asset. Talented colleagues working together in strong and collaborative teams drive performance and innovation to ultimately ensure the long-term success of EFG.

2026-2028 financial targets

In line with our commitment to sustainable value creation, EFG has set ambitious yet realistic financial targets for the 2026-2028 strategic cycle. We continue to aim for an annual net new asset growth rate of 4-6%. Additionally, we want to achieve a revenue margin of more than 85 basis points, a cost/income ratio of 68% and a return on tangible equity of 20%.

These financial targets are supported by additional ambitions that reflect our priorities for the 2026-2028 strategic cycle. They include average annual net profit growth of 15% across the period, the hiring of 50 to 70 new CROs each year, and cost savings of CHF 70-80 million by the end of 2028.

Our strong profit growth and capital generation enable us to continue pursuing a transparent and progressive capital return policy. We aim to distribute 60% of net profit to shareholders through dividend payments, while maintaining a management floor of 12% for the CET1 capital ratio. This capital management framework allows us to preserve our financial flexibility to support sustainable and profitable growth, including through selective acquisitions.

Becoming the private bank of choice for generations of clients

Our strategic priorities for the 2026-2028 cycle represent an important step towards the realisation of EFG’s Vision 2030: “To become the private bank of choice for generations of clients, delivering truly personalised and impartial advice”. As a partner to many multi-generational families, we want to build long-term relationships by offering the services, content, interactions and insights best suited to our clients’ needs.

Serving the next generation of wealth holders is a core strategic priority. EFG is developing a holistic and integrated approach to next-generation clients, encompassing wealth planning, sustainable investing, client experience, branding and engagement. Central to this approach is the continued evolution of our CRO model, which remains fundamental to EFG’s ability to attract, serve and retain clients over the long term.

Preparing for the Great Wealth Transfer

A significant intergenerational transfer of wealth is expected in the coming years, presenting both opportunities and responsibilities for private banks. To ensure continuity of client relationships and to strengthen its ability to serve families across generations, we have introduced the CRO Next-gen programme. This initiative is designed to enhance our talent pipeline by complementing the recruitment of experienced CROs with the development of next-generation relationship leaders, sourced both internally and externally.

As part of this programme, the newly introduced Junior CRO role provides a structured 36-month development framework for high-potential internal talent and selected external candidates. The role combines direct client exposure with ongoing mentorship from senior CROs, with the goal of preparing individuals for independent CRO responsibilities over time. This approach supports the long-term sustainability of EFG’s CRO model and strengthens our capacity to serve clients consistently across generations.

By investing in the development of our people and strengthening client relationships, we are well-positioned to capture the opportunities of tomorrow.

Global Divisions

Partnering across capabilities for our clients’ wealth journeys

Investment and Client Solutions and Global Markets divisions support our five private banking business regions are supported by two global divisions with a comprehensive products and services offering.

Connecting our offering to our clients

Augmented CRO – Ready to capture untapped opportunities

Embedded in EFG’s values

Local experts – globally

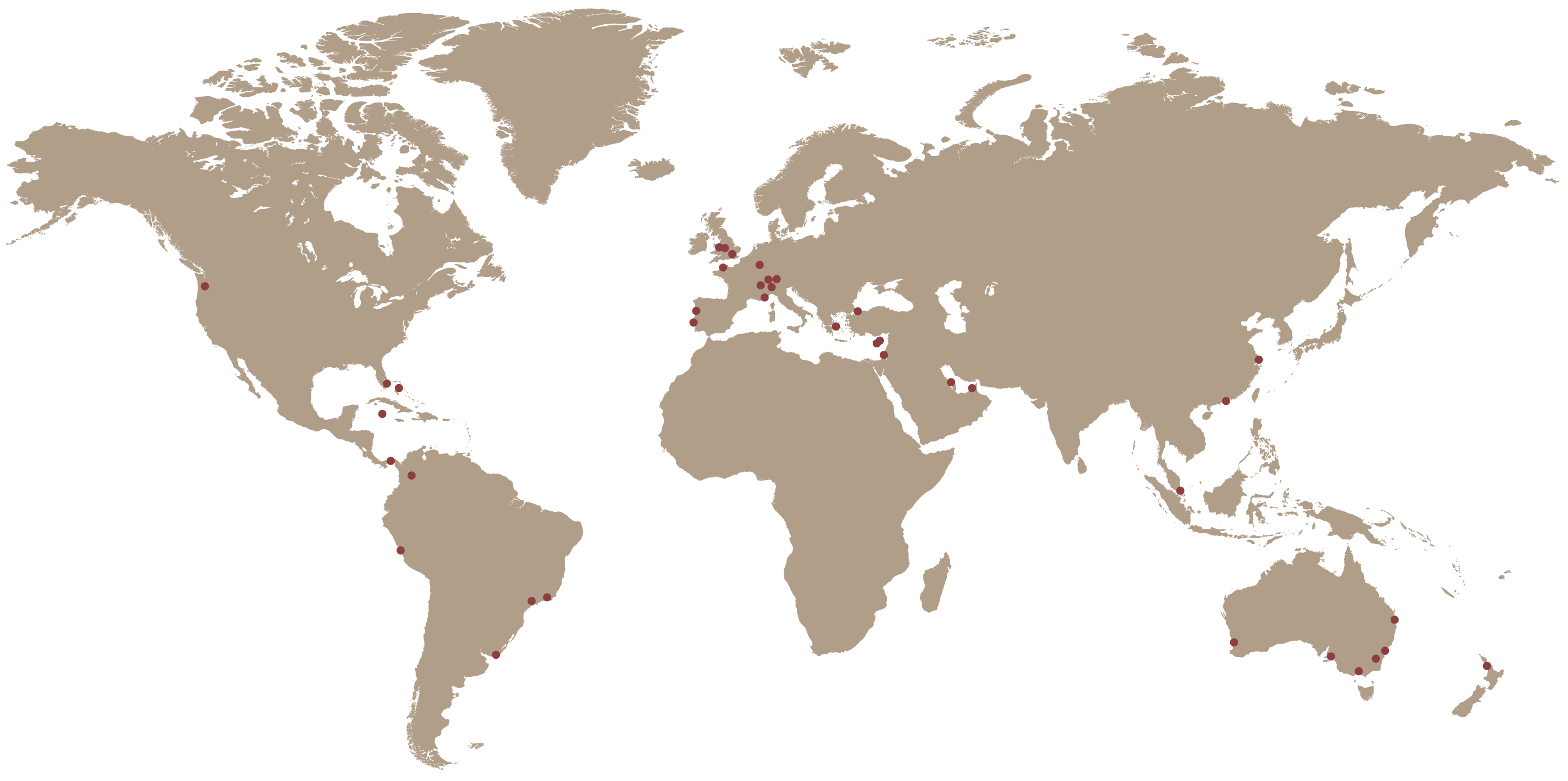

EFG was founded in Zurich – the Swiss financial centre at the heart of Europe and a city that is home to our headquarters. Switzerland’s solid, innovative and entrepreneurial economy continues to inspire our approach to business as we expand around the world.

With a presence in over 40 locations spanning every time zone from Asia Pacific to Europe and from the Middle East to the Americas, we are perfectly placed to partner with our clients and help them thrive. Our entrepreneurial spirit and dynamic collaborative approach, as well as our commitment to delivering outstanding service and advice, form the basis of our relationship with our clients.